Contents:

- 1 – Consumer behaviours have shifted

- 2- Buying and selling online is a growing trend

- 3 – Vinted rides the trend in the ‘second-hand’ marketplace

- 4 – How did TV advertising help Vinted have the edge over Depop

- 5 – The online buying and selling of vintage items is also booming

- 6 – Side hustlers are moving into promoting themselves on freelance sites

Consumer behaviours have shifted

With inflation reaching an all-time high across the United Kingdom and wages for many remaining stagnant, millions of Britons undoubtedly feel under pressure.

Salaries and benefits just aren’t covering as much of the cost of living in the UK as they once did, and neither the government nor many companies have yet to take substantial action.

But, consumers are finding efficient ways to diversify their income.

Buying and selling items online is a growing trend for generating income. Who are the people driving this?

According to our persona research, interest in second-hand clothing has increased by more than 42% in the last year compared to the previous year.

What’s particularly intriguing is how many consumers are using second-hand apps like Vinted, Shpock, Cash4Gold, Vintage Cash Cow, eBay and Depop to sell their unwanted goods to generate income. When comparing this year to last, the sale of clothing on websites like Vinted or eBay is up 24%.

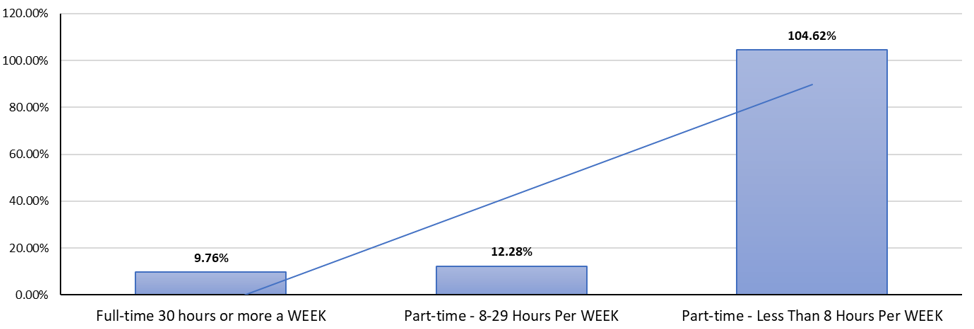

Those who work fewer than 8 hours a week are more likely to increase their habit of buying and selling items the most. People with lower income in lieu with uncertain employment are the group most affected by the cost-of-living crisis, and the segment least able to negotiate for higher compensation.

Looking at Gen Zs, a survey from Unidays 27 million student members revealed 75% of Gen Zs are shopping second-hand and 37% are reselling their clothes. An example of a campaign which has aided the ‘second-hand’ perception is eBay’s Love Island sponsorship and its rebranding of second-hand to ‘pre-loved’. Instead of a second-hand buyer being seen as a scrimper and saver, they’ve now become a savvy shopper.

Target: How often do you buy clothes online

Target: Selling at an auction online

Vinted rides the trend in the ‘second-hand’ marketplace

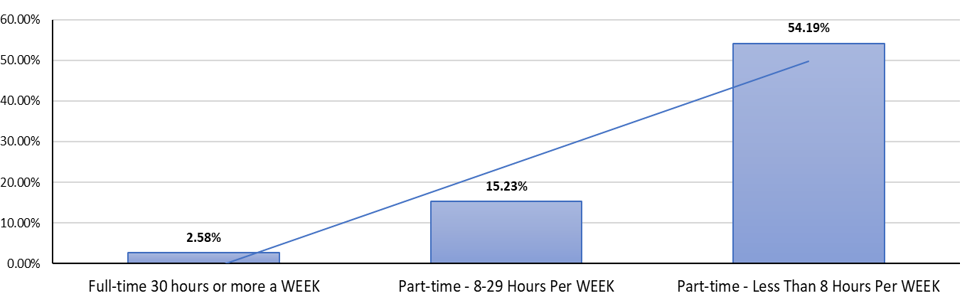

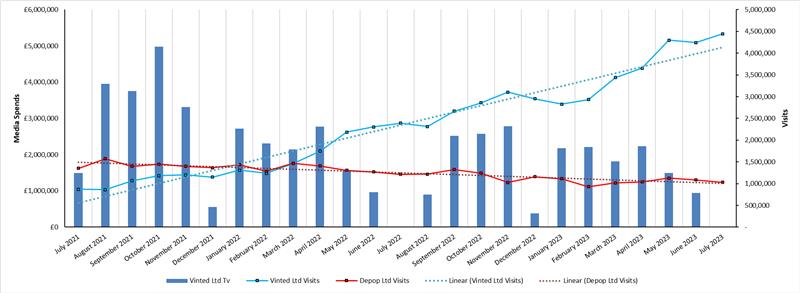

Buying and selling online has gained more and more traction every year and Vinted is unquestionably riding the trend, by targeting the population’s needs. It wasn’t until August 2022 (during which time inflation started to soar and the energy crisis is beginning to emerge) that visitor numbers had noticeably increased.

Vinted had built a significant amount of brand awareness in the market which made usage far more likely when people flocked to increase their side income in increasing times of need. By investing in TV so heavily early on, in combination with increased need due to external global factors, we can see it paid off. This, despite the fact they went as far as cutting media spend by 50% from the previous year during the cost-of-living crisis (Sources: Nielsen, Statista and SimilarWeb).

Cost-of-Living Pushing Demand

How did TV advertising help Vinted have the edge over it’s closest competitor, Depop?

Depop led the category in UK online visits from the summer up until February 2022 even though they were investing zero in offline media. On the other hand, Vinted, was putting in place an offline media strategy in order to stimulate web visits by promoting its services and increasing their brand awareness. But when the cost-of-living crisis hit hard, Vinted was already there having previously invested both heavy and early. Because of this, they were able to intercept the demand that was generated by the market conditions. Depop however, did not advertise as heavily as Vinted and so lost the opportunity to heighten their brand awareness amongst their target market.

The contrast between the two brands is now enormous. Depop took a different approach to advertising via influencers, partnerships, social media and creating communities instead of diversifying their media strategy to test TV. This could be seen as a limiting factor to it’s mass appeal in comparison to Vinted.

TV Investment Vinted vs Depop

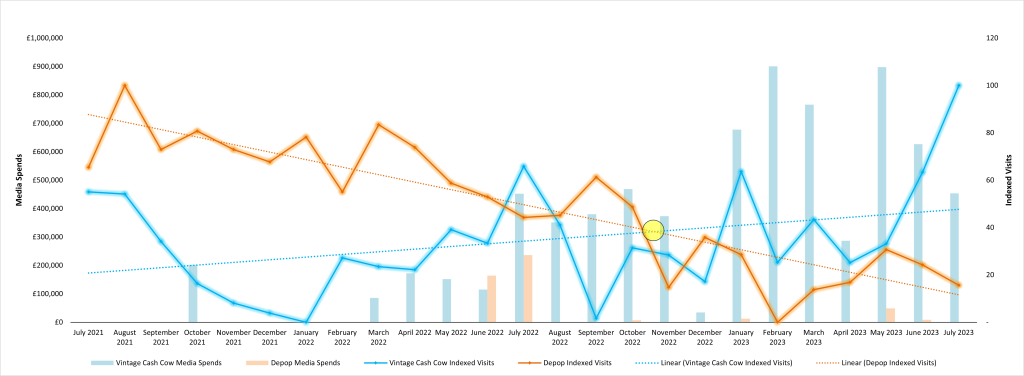

The online buying and selling of vintage items is also booming

Not only are clothes being sold and bought via second-hand apps, but Vintage items are also finding new owners.

In the graph below, you can see a similar trend to what we saw in the previous one. Notice the decline in visits in April 22 for Depop, just as it started to rise for Vintage Cash Cow. Once again the same narrative emerges. Vinted Cash Cow’s visits fluctuate but eventually soar thanks to a combination of investment in TV coupled with the demand that started to increase in late 2022 due to the rising cost of living.

Vintage Cash Cow vs Depop

Side-hustlers are moving into promoting themselves on freelance sites

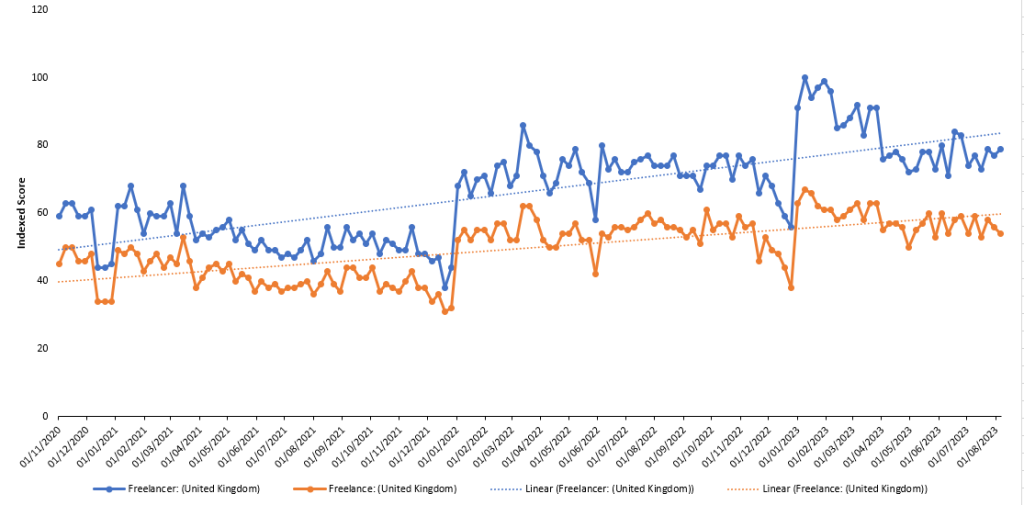

Data from Google Trends shows that there is a rapidly increasing demand for freelancing jobs to potentially diversify income streams.

Google trends data shows an increasing desire for freelance work beginning in early 2022 and peaking in December 2022, during a period when the energy crisis and inflation had a significant impact amongst Britain’s people.

Demand for Freelance Jobs UK – Google Trends

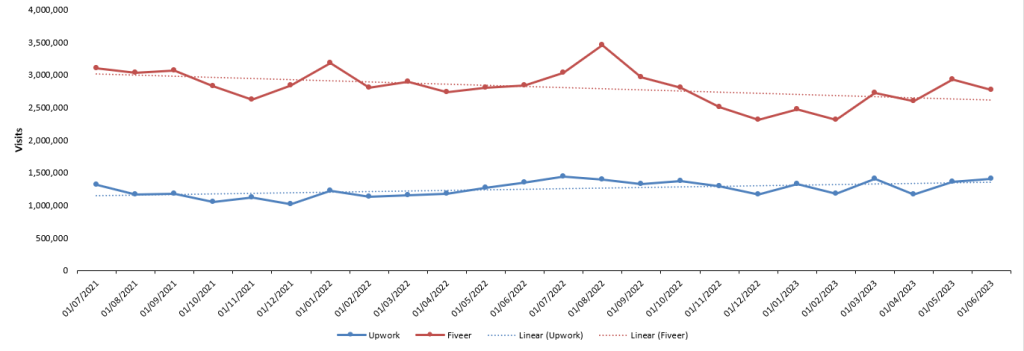

Despite an increasing demand for freelance jobs, Fiverr and Upwork (the two major providers of freelance work) are both unable to capture this audience, indicating an opposite trend.

Due to the high demand for freelance jobs, both Fiverr and Upwork should undoubtedly be able to take advantage of the growing appetite for freelance work, and to do so, they might consider investing in TV.

Fiverr vs Upwork

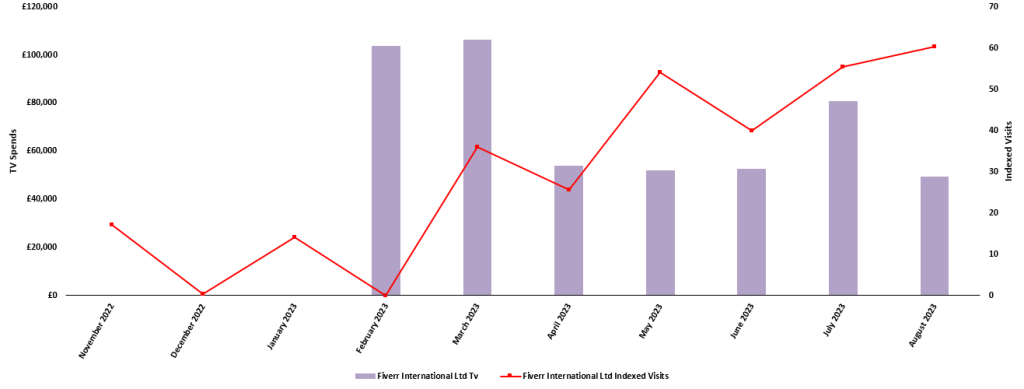

Fiverr TV Investments

In the chart above, we can see that from Feb 2023, Fiverr began investing heavily in TV, which resulted in a substantial increase in indexed visits.

How can categories catering to the side-hustle market capture this growing demand?

Dylan Moss

London Director

LinkedIn

“The difficult economic backdrop over the last 12-18 months has seen interest and action of people looking to supplement their incomes, either through selling unwanted goods or perhaps looking at side-hustles and other types of freelance work.

Brands who invested strategically in high impact, authoritative media, including TV, with a view to growing their awareness and consideration prior to the cost-of-living crisis emerging, have reaped the benefits of the subsequent economic climate. Additionally, those brands who have switched on a similar media approach during the crisis, are also able to harvest current demand.

Although inflation has receded towards the end of 2023, the sentiment into 2024 suggests more challenging times ahead. Coupled with a softer, beneficial, media pricing market tailwind, other businesses in sectors able to help individuals navigate these times more favourably, could prosper by activating effective, volume-driving media channels, including broadcast.

Value-based retailers, discounters, pawnbroker chains and even the cash-for-gold type businesses who were very active after the 2008 financial crisis and high gold price period, immediately spring to mind. B2B services enabling elements of side-hustle or freelance operations could also maximise their opportunity. Invoicing, card-reader or other financial services, package delivery and even training and learning type businesses are all candidates.

In summary, though the economy and cost-of-living crisis presents ongoing challenges, now is still a great time to market and advertise if the offering can provide solutions to consumers and businesses alike.”

FEATURED READS

All Response Media services

Digital

Make your digital presence profitable. Supercharge your online paid media campaigns using our audience-first approach.

Offline

Be where your audience wants you to be. All Response Media provide full planning, delivery and optimisation to your offline campaigns.

Data & Systems

Our ARMalytics platform provides services tailored to your audience’s needs. We provide full performance attribution and transparency.

Get in touch today

Get a second opinion on your advertising investment. Find out how Europe’s largest performance marketing agency can combine data science with TV, digital and offline advertising expertise to drive business performance.