INDUSTRY ANALYSIS

Travel Advertising Report

Covers the Travel industry’s trends, audience insights and key takeaways for Travel brands to make the most of their online and offline marketing strategy.

Be on the lookout for data and insight on the following Travel companies and more:

Travel Industry Trend

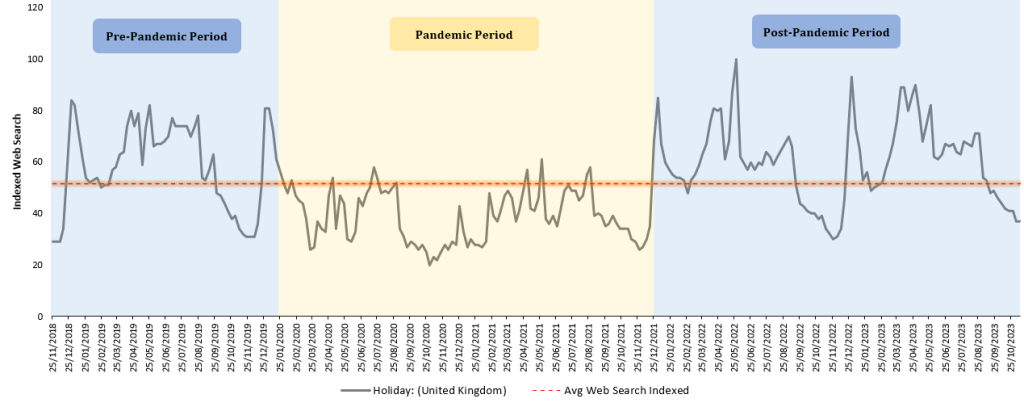

Using Google Trends historical data, we can see how the topic ‘Holiday’ in the UK (which is linked to the interest/intent to book a holiday) has returned to pre-pandemic levels.

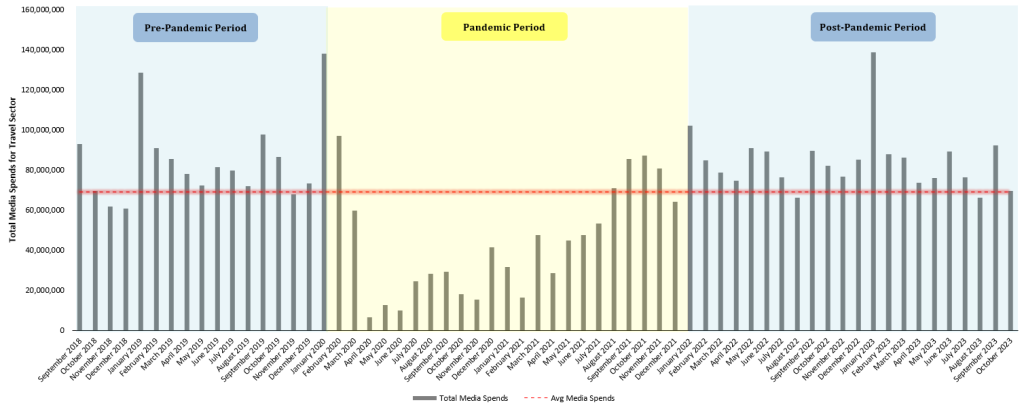

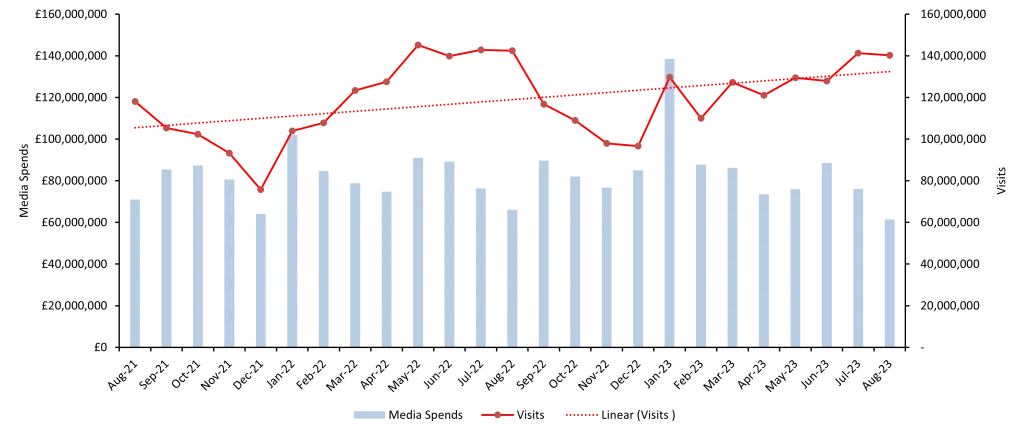

As you can see above also, the media spends for the travel sector have started to bounce back after declining in March 2020 due to the pandemic. Starting in January 2022, you can see they began to return to normal levels.

With the two charts showing that demand and investments made by brands operating in the travel sector are now back to normal, there is no risk for travel brands wanting to invest in advertising to waste money. This is because the market is now at full potential.

The Travel industry has been following a clear trend for the last 3 years. According to the key terms associated with travel, search intent is now returning to pre-pandemic levels.

Full Travel Sector

Media Spend vs Visits

Late peak is the travel industry’s most popular ad slot

Morning hours are not thought to be particularly crucial for the industry, with early Peak and Pre-Peak also representing a sizable amount of TV investments.

The two charts below show the disparity between these three slots and the other dayparts. When we look at the second chart in particular, looking at the percentage impacts, you can see the Travel industry is following closely the trend of ALL the industries combined.

The only difference of note is in the Early-Peak, where the Travel industry invests 8 points more.

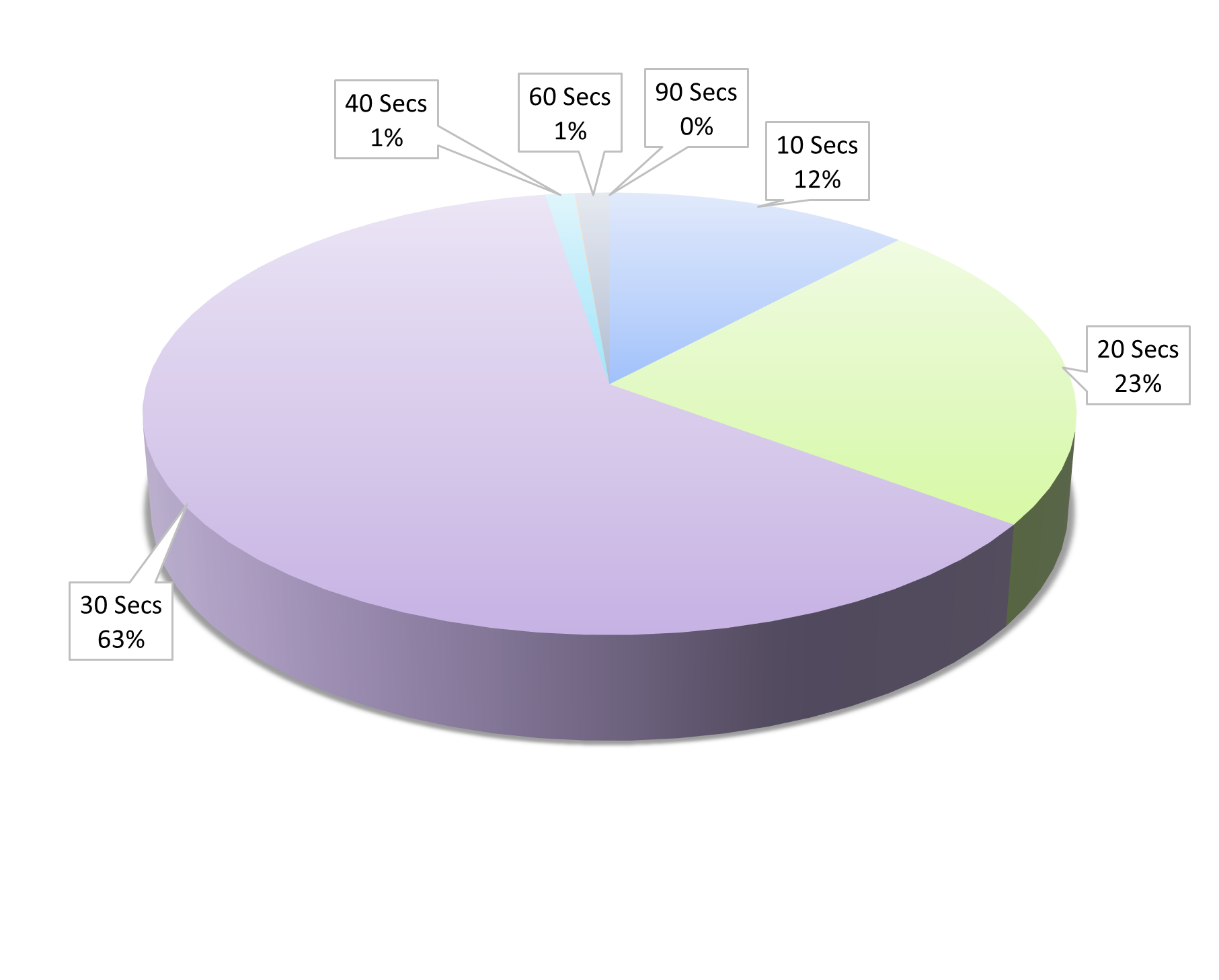

30 seconds ads are the most used in the travel industry

63% of ALL ads in the travel industry are 30 seconds long.

The typical ‘storytelling or relationship-building’ 60/90 second commercials don’t seem to be a part of the travel industry’s advertising strategy.

The two most important metrics for activation and brand-building

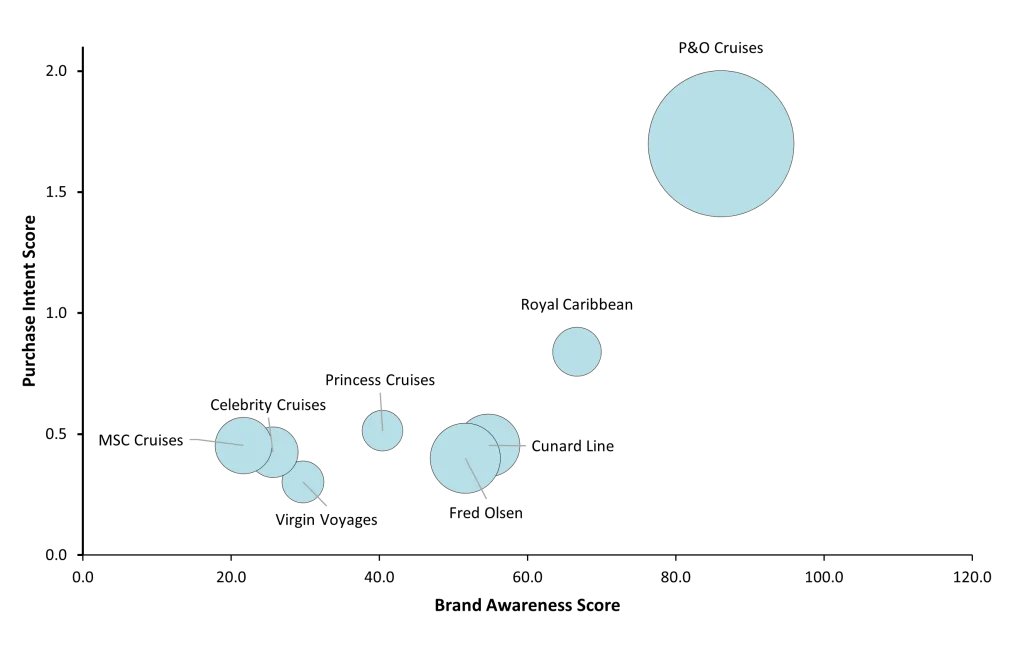

The chart below combines two of the most important metrics for activation and brand building strategies.

Below, you can see that only P&O have been able to successfully combine purchase intent and brand awareness, while the majority of brands exhibit poor purchase intent and very low brand recognition.

An all-encompassing method of audience analysis is purchasing intent. It combines demographic and behavioural data to consider not just the characteristics of your leads but also the steps they take to learn more about your business.

An extremely low purchase intent score shows that a business is struggling to attract new customers and increase their buying intent.

DRTV is one of the best ways to pique the interest of new customers, and when used in combination with a long-term branding strategy, it may yield significant results, increasing awareness too.

Access the latest Travel Industry Report now

FEATURED READS

All Response Media services

Digital

Make your digital presence profitable. Supercharge your online paid media campaigns using our audience-first approach.

Offline

Be where your audience wants you to be. All Response Media provide full planning, delivery and optimisation to your offline campaigns.

Data & Systems

Our ARMalytics platform provides services tailored to your audience’s needs. We provide full performance attribution and transparency.

Get in touch today

Get a second opinion on your advertising investment. Find out how Europe’s largest performance marketing agency can combine data science with TV, digital and offline advertising expertise to drive business performance.